International Investment Markets Update September 2025

International Investment Markets Update

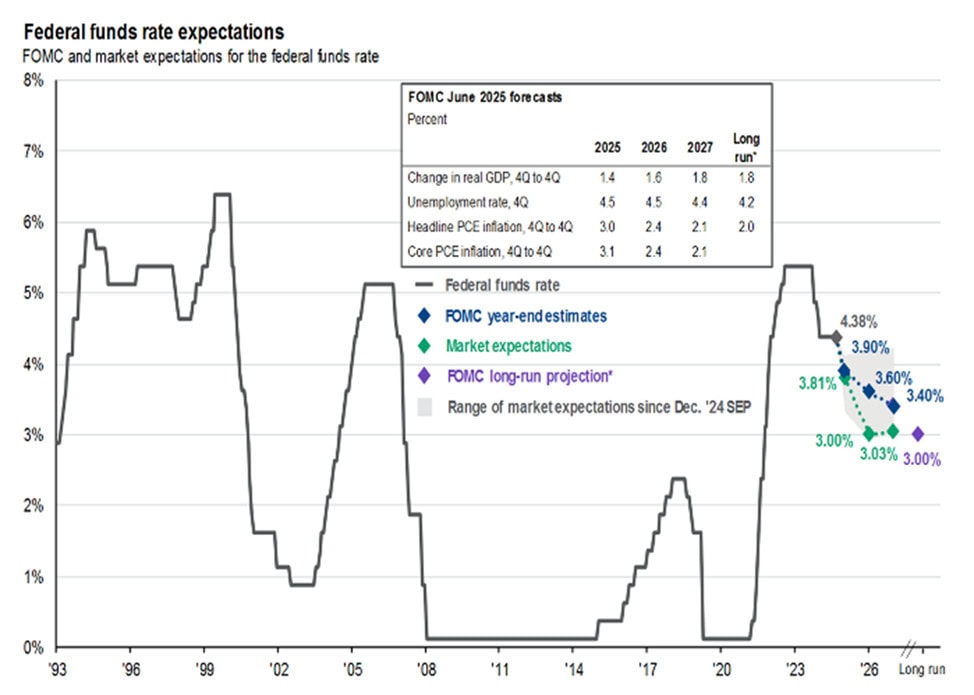

In the US, September was a particularly bullish month, with stocks rallying slightly and data supporting the economy. The geopolitical situation in the Middle East, and Ukraine in particular, does not appear to be resolving itself any time soon, as President Trump himself has stated. The Federal Reserve (Fed) made a small but significant interest rate cut of 0.25%, paving the way for growth by reducing borrowing costs, something that the market had already priced in. In economic announcements, inflation was announced at 2.9% (marginally better, heading towards the 2% target), unemployment at 4.3%, GDP grew by 3.3% in the second quarter, retail sales increased by 5% and industrial production by 0.87% (August 2025 data).

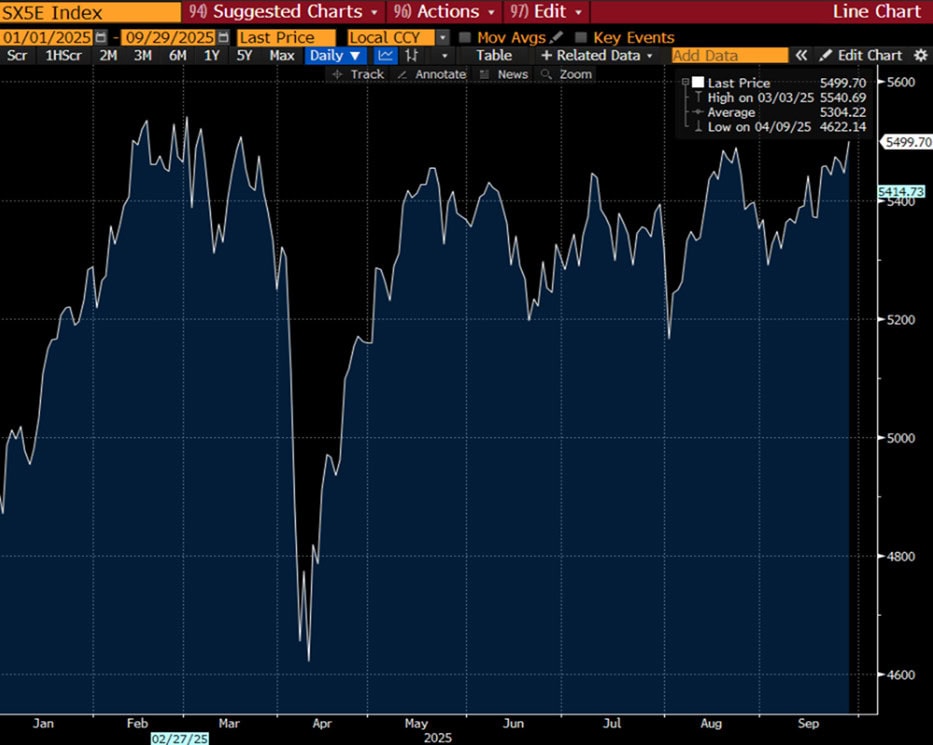

S&P-500 (9-month chart)

Source: www.bloomberg.com

In Europe, the situation is less favorable, with France being the main stumbling block, as its credit rating was downgraded by Fitch to A+ with a deficit reaching €80 billion, while the wealth tax that the left is calling for will cause capital flight abroad and is estimated to cover just €20 billion. In Germany, Porsche shares were removed from the DAX index, confirming the major issue of the automotive industry in the country, which is affecting the economy. The latter is suffering from its fiscal problem, with the main thorn in its side being the aging population, which costs €400 billion a year in pensions. In the eurozone announcements, inflation stood at 2.3%, retail sales at 2.2%, GDP for the second quarter at 1.5%, industrial production up 1.8% and interest rates stable at 2%.

Eurostoxx-50 (9-month chart)

Source: www.bloomberg.com

In Greece, the stock market continued its upward trend, GEK TERNA’s 7-year bond with a coupon of 3.2% was oversubscribed 2.4 times, with 70% going to private investors and 30% to institutional investors, once again demonstrating the vote of confidence in the Greek capital market. The Prime Minister’s statements at the Thessaloniki International Fair were tax-relieving and further boosted the already positive climate, which was confirmed by the good data announced earlier in August, with unemployment at 8.0%, inflation at 2.9%, and GDP growth in the second quarter at 0.6%.

The EUR/USD exchange rate moved towards 1.17 and, despite lower interest rates compared to the US currency, the euro is expected to remain on an upward trend due to the supply of the US currency.

EUR/USD (9-month chart)

Source: www.bloomberg.com

On the interest rate front, the US Federal Reserve cut interest rates by 0.25% to 4%, while the ECB remained steady at 2% but considers a rate cut possible by the end of the year. The ECB is maintaining a wait-and-see attitude, but is giving the market the opportunity to continue its upward trend, as European interest rates in particular are very low.

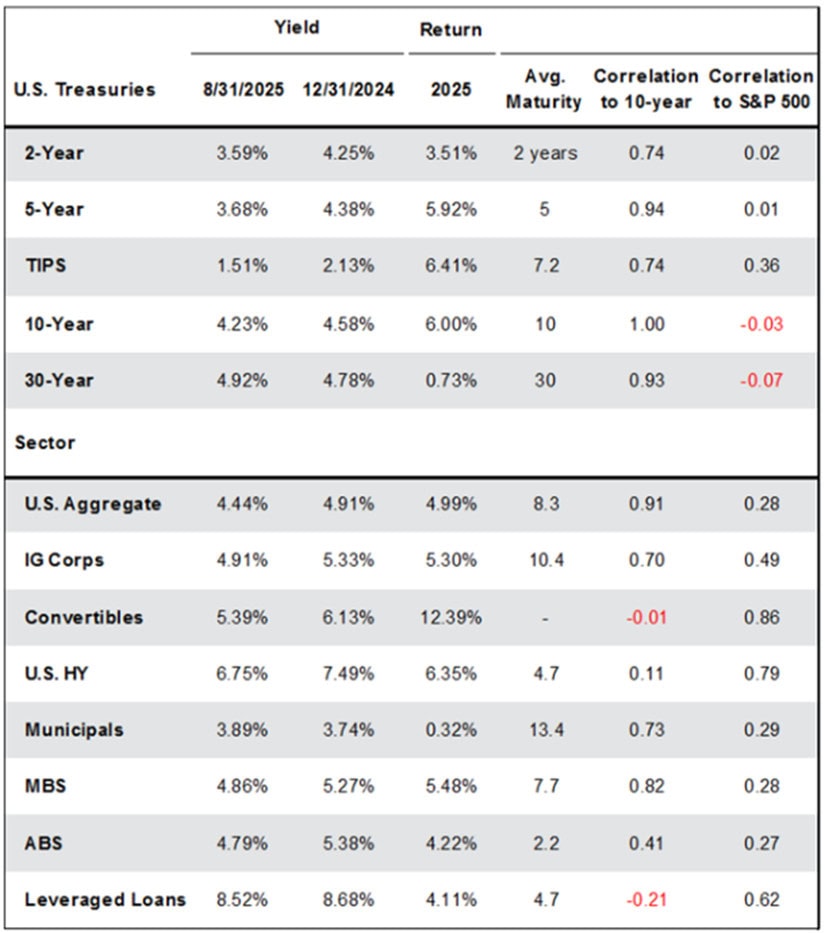

Source: JP Morgan Guide to the Markets US3Q 2025

Source: JP Morgan Guide to the Markets US3Q 2025

The bond market initially moved downward and then upward. Their movement in September was the opposite of that of stocks and disappointment at the failure to reach a solution on the Ukraine issue. Investor interest is focused on medium-term bond maturities, mainly 5-7 years, where the largest volume is concentrated. In general, no significant returns are expected on European bonds until the end of 2025, as they are already yielding low returns (below 2.5%). US bonds, on the other hand, present a more attractive picture, with yields on 10-year and 30-year government bonds reaching 4.2% and 4.9% respectively.

Source: JP Morgan Guide to the Markets US3Q 2025

Disclaimer – Disclosures:: The bond market initially moved downward and then upward. Their movement in September was the opposite of that of stocks and disappointment at the failure to reach a solution on the Ukraine issue. Investor interest is focused on medium-term bond maturities, mainly 5-7 years, where the largest volume is concentrated. In general, no significant returns are expected on European bonds until the end of 2025, as they are already yielding low returns (below 2.5%). US bonds, on the other hand, present a more attractive picture, with yields on 10-year and 30-year government bonds reaching 4.2% and 4.9% respectively.