Global Economic and Markets Outlook 2025

Global Economic and Market Outlook 2025

The year 2025 is poised to bring a mix of challenges and opportunities to the global economy and markets. As we move into the mid-decade, structural adjustments, evolving geopolitical tensions, and the lingering effects of inflation and monetary policy tightening will shape economic and market outcomes. Below is a detailed analysis of key factors expected to drive the global economy and financial markets.

Macroeconomic Overview

- Global Growth

- Growth Projections: Global GDP is expected to expand by approximately 3.2% in 2025, driven by resilient services sectors in developed markets and a recovery in emerging economies like India and Brazil.

- Key Drivers:

- Recovery in China, aided by targeted fiscal stimuli and a rebound in consumer confidence.

- U.S. economy expected to avoid a hard landing, with growth stabilizing around 2% following robust labor market performance.

- Europe faces slower growth at around 1.2%, constrained by energy transition costs and tepid demand.

- Inflation Dynamics

- Inflationary pressures are subsiding, with developed markets targeting a 2%-2.5% range by Q3 2025.

- Emerging markets face varying inflation profiles, with commodity-exporting nations benefiting from stable raw material prices.

- Persistent wage growth in developed markets may hinder the pace of disinflation.

- Central Bank Policies

-

- Central banks are expected to maintain a cautious stance. The Federal Reserve and European Central Bank (ECB) are likely to keep rates elevated through mid-2025, focusing on data-dependent adjustments.

- In contrast, China’s monetary policy remains accommodative, aiming to bolster its post-pandemic recovery.

Regional Outlook

- United States

- Consumer resilience, bolstered by high employment rates, is a key factor in stabilizing growth.

- Fiscal policy headwinds, such as potential government shutdown risks, may create volatility.

- The tech and renewable energy sectors are expected to outperform due to increased investment incentives.

- Europe

- The region grapples with energy supply diversification, impacting industrial competitiveness.

- Fiscal policy fragmentation among EU members may limit coordinated growth initiatives.

- Green transition policies present both opportunities (clean tech) and risks (carbon taxes).

- Asia-Pacific

- China is forecasted to grow at 5%, spurred by consumer-led recovery and infrastructure spending.

- India’s economy remains robust, driven by digitalization and manufacturing sector expansion.

- Japan’s policy adjustments may strengthen the yen, potentially impacting export competitiveness.

Financial Markets

- Equities

- Outlook: Equity markets are expected to deliver moderate returns, with sector rotation favoring technology, healthcare, and renewable energy.

- Valuations: High-interest rates could pressure valuations, particularly in growth stocks.

- Key Risks: Geopolitical tensions (e.g., U.S.-China relations), earnings downgrades in cyclical sectors.

- Fixed Income

- Government Bonds: Attractive entry points emerge in U.S. Treasuries and German Bunds as yields stabilize.

- Corporate Bonds: Credit spreads remain tight, but higher-rated bonds offer better risk-adjusted returns.

- Emerging Market Debt: Gains likely, driven by dollar weakness and stabilizing local currencies.

- Currencies

- The U.S. dollar is expected to weaken gradually, driven by narrowing rate differentials.

- The euro and yen may appreciate, while emerging market currencies stabilize following a turbulent 2024.

- Commodities

- Energy: Oil prices likely to hover around $80-$90 per barrel due to OPEC+ supply discipline.

- Metals: Increased demand for green technologies supports higher prices for lithium, cobalt, and copper.

- Agriculture: Weather-related risks and geopolitical disruptions could cause intermittent price spikes.

Investment Implications

- Asset Allocation

- Diversification remains critical, with a focus on balancing equity exposure with high-quality fixed income.

- Overweight sectors benefiting from secular trends, such as technology, healthcare, and renewables.

- Underweight cyclical sectors exposed to slowing global demand, such as traditional manufacturing and energy.

- Risk Management

- Monitor geopolitical developments and central bank communication for signs of market disruption.

- Employ hedging strategies, particularly in currency and commodity markets.

- Thematic Investing

- Green energy, AI-driven automation, and infrastructure renewal offer long-term growth opportunities.

- ESG-focused investments continue to attract capital as regulatory frameworks evolve globally.

Conclusion

The global economic and market landscape in 2025 presents a mix of cautious optimism and tactical challenges. Investors should remain vigilant, balancing growth opportunities with risk mitigation strategies. While macroeconomic uncertainties persist, aligning portfolios with structural growth themes and regional strengths will be key to achieving robust returns in the year ahead.

Asset Allocation Strategy for 2025

Under the 2025 outlook, global financial markets will likely navigate a period of moderate economic growth, stabilizing inflation, and elevated interest rates. These dynamics necessitate a balanced, diversified approach to asset allocation, with a focus on sectors and geographies offering resilience and growth potential.

Strategic Allocation

- Equities (45-55%)

- Core Allocation:

- Focus on high-quality, large-cap equities in developed markets, particularly in the U.S. and Europe.

- Prioritize sectors such as technology, healthcare, and renewable energy, which benefit from structural growth trends.

- Emerging Markets:

- Increase exposure to Asia-Pacific, particularly China (consumer recovery) and India (manufacturing growth).

- Select Latin American markets for commodity-driven opportunities.

- Tactical Adjustments:

- Reduce allocations to cyclical sectors like industrials and traditional energy, which are more vulnerable to slowing global demand.

- Avoid overexposure to overvalued growth stocks that could face valuation compression in a high-rate environment.

- Core Allocation:

- Fixed Income (30-40%)

- Government Bonds:

- Favor U.S. Treasuries and German Bunds for safety and yield, as rates stabilize at elevated levels.

- Allocate to inflation-linked bonds for hedging against potential upside inflation risks.

- Corporate Bonds:

- Focus on investment-grade corporate debt for stable returns and minimal credit risk.

- Limited exposure to high-yield bonds, given the risk of spread widening in a slower growth scenario.

- Emerging Market Debt:

- Select opportunities in local currency-denominated debt as emerging market currencies stabilize.

- Government Bonds:

- Alternatives (10-15%)

- Commodities:

- Maintain exposure to metals like copper, lithium, and cobalt, driven by demand from green technologies.

- Modest allocation to oil and natural gas for diversification but expect subdued returns.

- Real Estate:

- Invest in sectors benefiting from megatrends, such as logistics and data centers.

- Caution on retail and office real estate, which face secular headwinds.

- Private Markets:

- Consider private equity and infrastructure funds with a focus on sustainability and digital transformation.

- Commodities:

- Cash and Short-Term Instruments (5-10%)

- Maintain liquidity to capitalize on market dislocations and to hedge against potential volatility.

- Favor short-duration instruments with attractive yields given the high-rate environment.

Regional Allocation

- United States (35-45%)

- Focus on resilient sectors like technology, healthcare, and consumer staples.

- Attractive fixed-income opportunities in Treasuries and investment-grade corporates.

- Europe (20-30%)

- Moderate equity exposure, emphasizing defensive sectors (utilities, healthcare) and green transition leaders.

- Allocate to core government bonds for safety and steady income.

- Asia-Pacific (20-30%)

- Favor equities in China (post-pandemic recovery) and India (digitalization, manufacturing growth).

- Select fixed-income opportunities in Asia for diversification and yield.

- Emerging Markets (5-10%)

- Target countries benefiting from commodity exports and stable fiscal policies.

- Allocate selectively to emerging market debt, focusing on local currency instruments.

Thematic Investments

- Green Energy: Allocate to companies driving renewable energy adoption, EV supply chains, and carbon reduction technologies.

- Digital Transformation: Invest in AI, cloud computing, and automation technologies.

- Infrastructure: Position in funds targeting modernization and sustainable infrastructure development.

Risk Considerations

- Inflation Persistence: Mitigate risks by maintaining exposure to inflation-linked assets.

- Geopolitical Uncertainty: Employ diversification across geographies and currencies to reduce geopolitical risks.

- Central Bank Policy: Monitor central bank communication and adjust duration risk in fixed income portfolios accordingly.

Conclusion

In 2025, the emphasis should be on a balanced allocation strategy that capitalizes on structural growth trends while mitigating downside risks. Diversification across asset classes, sectors, and geographies will remain key to optimizing returns in a dynamic and uncertain economic environment.

All-Equity Asset Allocation with a U.S. Bias for 2025

Focusing on an all-equity portfolio with a U.S. bias requires balancing the strength of U.S. markets with diversification to capture growth opportunities globally. The allocation below reflects the resilience of U.S. equities, particularly in technology and healthcare, while including limited exposure to high-growth international markets.

Proposed Allocation

- U.S. Equities (65-70%)

The U.S. remains a strong performer with robust corporate earnings, innovation in key sectors, and a resilient economy. A U.S.-centric approach should emphasize:- Technology (30-50%):

- Prioritize leaders in AI, cloud computing, and semiconductors (e.g., NVIDIA, Microsoft, Alphabet).

- Include mid-cap tech companies driving niche innovations, such as cybersecurity and automation.

- Healthcare (10-20%):

- Focus on pharmaceutical giants with strong pipelines and biotech companies offering high growth potential.

- Allocate to health tech firms leveraging AI and data analytics for efficiency improvements.

- Consumer Discretionary and Staples (5-10%):

- Invest in consumer-facing companies benefiting from strong spending and post-pandemic trends.

- Include e-commerce leaders and premium brands targeting affluent consumers.

- Renewable Energy and Infrastructure (1-5%):

- Add exposure to companies leading in clean energy and infrastructure modernization, capitalizing on federal incentives.

- Technology (30-50%):

- International Developed Markets (15-20%)

While the portfolio has a U.S. bias, diversification is essential to mitigate domestic risks and capture global opportunities.- Europe (5-10%):

- Focus on green energy and luxury goods companies.

- Select defensive sectors like utilities and healthcare for stability.

- Japan (0-5%):

- Consider firms benefiting from corporate governance reforms and yen strength.

- Allocate to automation and robotics leaders.

- Europe (5-10%):

- Emerging Markets (10-15%)

Emerging markets offer growth potential, especially in Asia, where demographic and economic trends are favorable.- Asia (7-10%):

- Allocate to Chinese consumer and tech companies as the economy rebounds.

- Focus on Indian firms in digitalization and manufacturing.

- Latin America (2-5%):

- Include commodity exporters benefiting from global demand for raw materials, particularly in Brazil.

- Asia (7-10%):

Sector Focus

- Technology (30-50%):

- Dominant allocation due to strong earnings growth, secular trends in AI, and automation adoption.

- Healthcare (10-20%):

- Defensive growth with innovation-driven upside.

- Consumer (5-10%):

- Both discretionary and staples to balance growth with stability.

- Energy and Green Transition (1-5%):

- Focus on companies aligned with the energy transition.

- Financials and Industrials (5-10%):

- Include selective exposure to financials benefiting from high rates and industrials tied to U.S. infrastructure growth.

Regional and Sector Breakdown

| Region | Allocation | Sector Highlights |

| United States | 65-70% | Technology, Healthcare, Renewables, Consumer Staples |

| Europe | 5-10% | Green Energy, Luxury Goods, Healthcare |

| Japan | 5-8% | Automation, Robotics, Corporate Reforms |

| Emerging Markets | 10-15% | Chinese Tech, Indian Manufacturing, Commodities |

Key Considerations for 2025

- Sector Leadership:

- Overweight sectors leading in innovation and structural growth, like technology and healthcare.

- Avoid overexposure to cyclicals prone to slowing global demand.

- Currency Risks:

- With a U.S.-biased portfolio, consider the potential impacts of a weakening dollar on international holdings.

- Geopolitical Risks:

- Monitor U.S.-China tensions, which could affect multinational tech and consumer goods companies.

- Rebalancing:

- Regularly review allocations to ensure alignment with market conditions and long-term goals.

Conclusion

An all-equity allocation biased toward the U.S. leverages the strength of American innovation and economic stability while capturing global opportunities for growth. The portfolio should focus on technology, healthcare, and consumer-facing sectors to drive returns, with selective international exposure for diversification and upside potential.

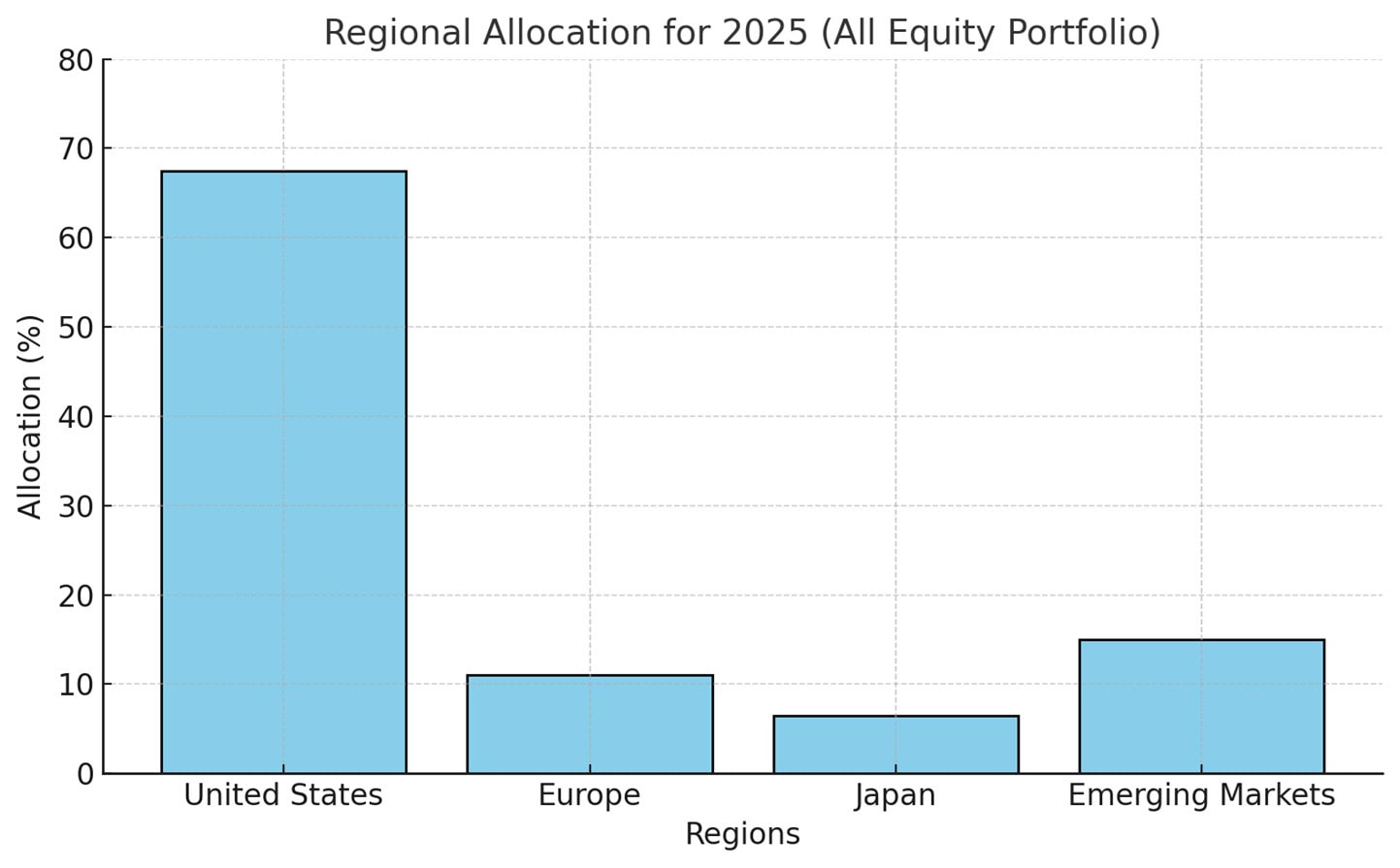

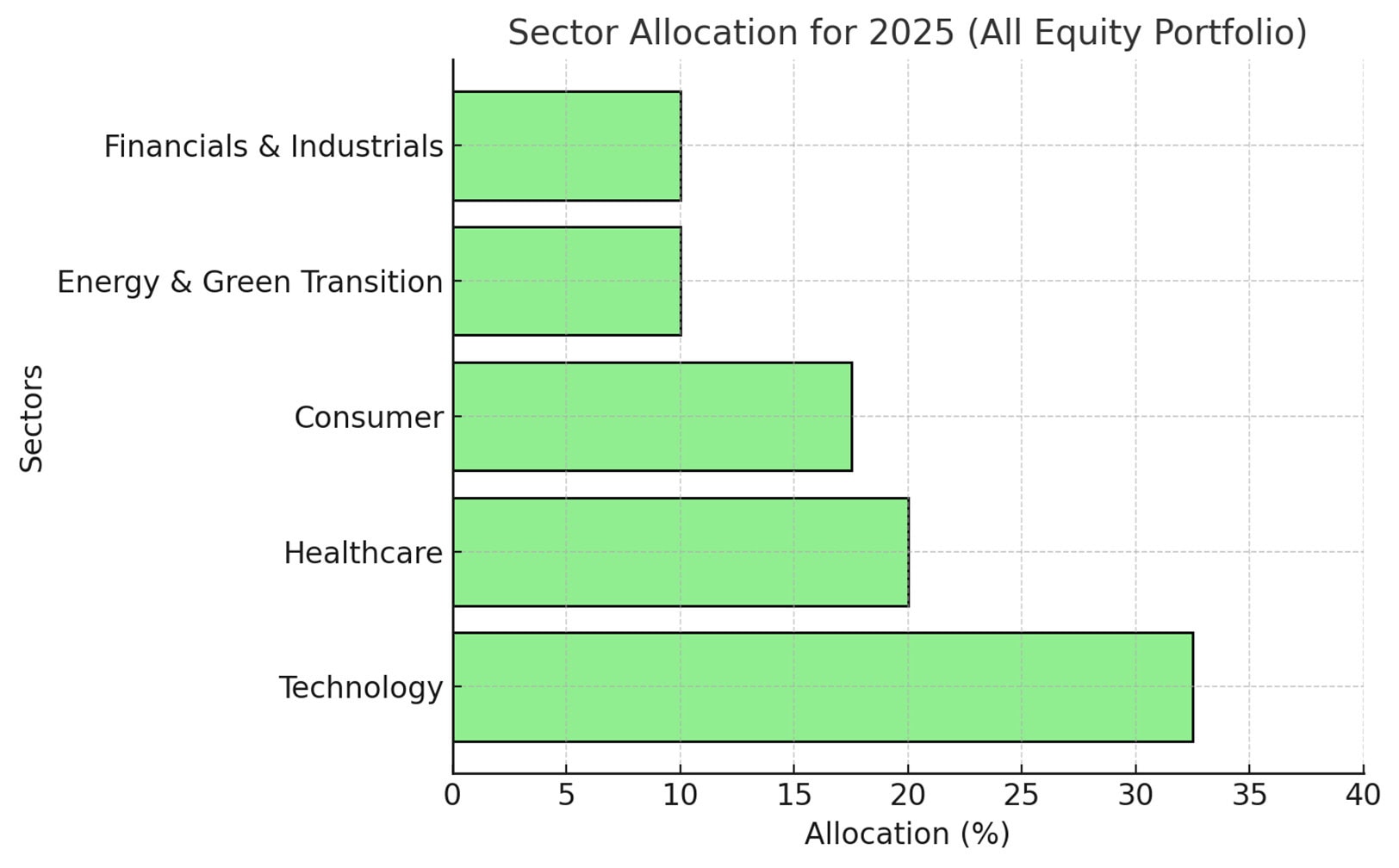

Regional Allocation for 2025 / Sector Allocation for 2025 (All Equity Portfolio)

The graphs above illustrate the proposed Regional Allocation and Sector Allocation for an all-equity portfolio with a U.S. bias for 2025:

- Regional Allocation: Highlights the dominant weighting of U.S. equities (67.5%) while maintaining exposure to Europe, Japan, and Emerging Markets for diversification.

- Sector Allocation: Emphasizes key sectors such as Technology (32.5%) and Healthcare (20%) as primary drivers of growth, with balanced allocations across Consumer, Energy & Green Transition, and Financials & Industrials.

These allocations align with the strategy to capture growth in resilient U.S. markets while leveraging global opportunities.

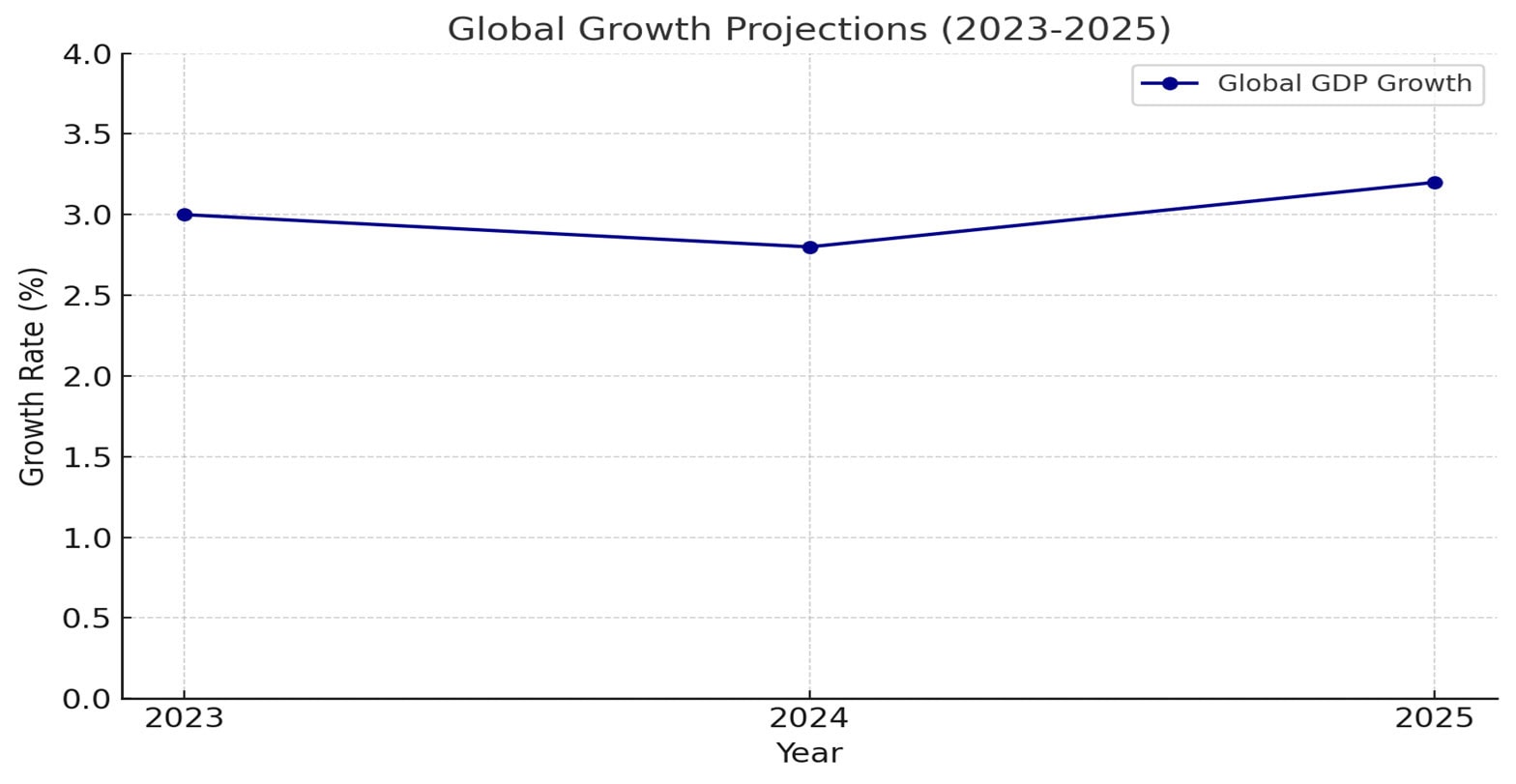

Global Growth Projections (2023-2025)

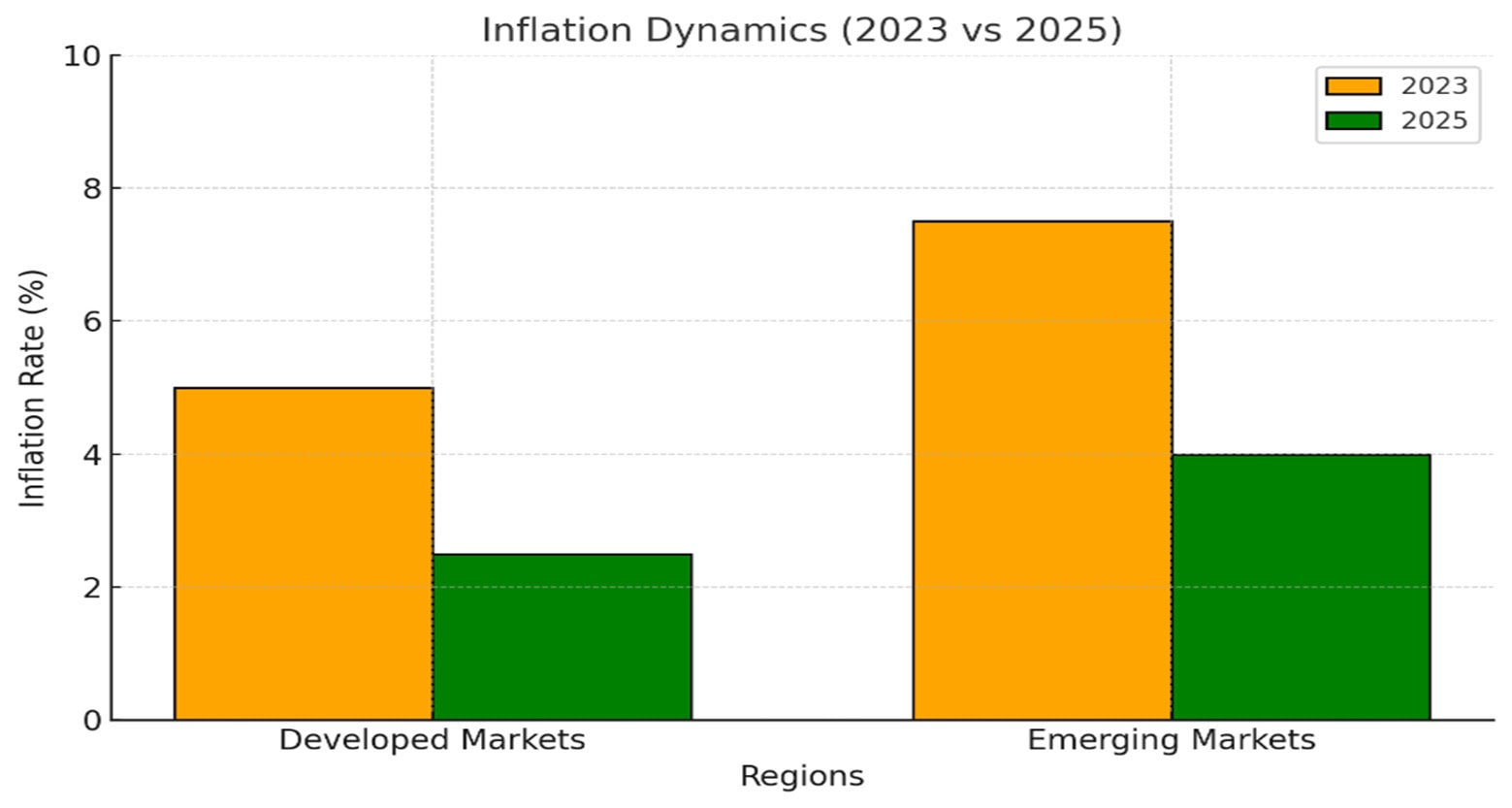

Inflation Dynamics (2023 vs 2025)

The graphs above depict the Macro Environment for 2025:

- Global Growth Projections: Displays the recovery in global GDP growth, rising from 2.8% in 2024 to 3.2% in 2025, signaling a stabilizing economic environment driven by improved performance in both developed and emerging markets.

- Inflation Dynamics: Compares inflation rates in developed and emerging markets between 2023 and 2025. Developed markets see inflation decreasing from 5.0% to 2.5%, while emerging markets improve from 7.5% to 4.0%, reflecting effective monetary policies and stabilized commodity prices.

These trends underline a more favorable macroeconomic environment for strategic investment planning.

Sectors Driving U.S. Growth in 2025

In 2025, several key sectors are expected to drive U.S. economic growth, fueled by innovation, policy support, and shifting consumer and business priorities. Below are the top sectors poised for growth:

- Technology

- Drivers:

- Rapid adoption of artificial intelligence (AI) in automation, cybersecurity, and cloud computing.

- Expansion of 5G infrastructure and the Internet of Things (IoT).

- Continued dominance of U.S. tech giants (e.g., Alphabet, Microsoft, NVIDIA) in global markets.

- Growth Areas:

- AI-powered applications across industries.

- Semiconductor innovation for emerging technologies.

- Cybersecurity demand due to increasing cyber threats.

- Drivers:

- Healthcare and Biotechnology

- Drivers:

- Aging population and increased healthcare spending.

- Advances in personalized medicine, genomics, and telemedicine.

- Integration of AI and big data analytics to improve diagnostics and treatments.

- Growth Areas:

- Biotech firms innovating in gene therapies and biologics.

- Health tech companies enabling remote healthcare delivery.

- Pharmaceuticals addressing chronic and infectious diseases.

- Drivers:

- Renewable Energy and Clean Tech

- Drivers:

- Federal incentives through policies like the Inflation Reduction Act (IRA).

- Corporate and government commitments to net-zero emissions targets.

- Growth in electric vehicles (EVs) and associated infrastructure.

- Growth Areas:

- Solar, wind, and battery storage technologies.

- Green hydrogen production and carbon capture solutions.

- EV charging networks and supply chains.

- Drivers:

- Consumer Discretionary

- Drivers:

- Resilient consumer spending supported by a strong labor market.

- Increased demand for e-commerce and direct-to-consumer (DTC) brands.

- Revival in travel, leisure, and entertainment sectors.

- Growth Areas:

- High-end and luxury goods catering to affluent consumers.

- Experience-driven industries like tourism and dining.

- E-commerce platforms optimizing delivery and personalization.

- Drivers:

- Industrials and Infrastructure

- Drivers:

- Investments in infrastructure modernization through federal spending programs.

- Growth in advanced manufacturing, including robotics and automation.

- Increased focus on sustainable building materials and methods.

- Growth Areas:

- Transportation infrastructure (roads, bridges, rail).

- Renewable energy projects and grid modernization.

- Smart cities and urban planning technologies.

- Drivers:

- Financial Services

- Drivers:

- Higher interest rate environment supporting net interest margins for banks.

- Fintech innovation disrupting traditional banking models.

- Increased focus on ESG investing and green financing.

- Growth Areas:

- Digital payment systems and decentralized finance (DeFi).

- Wealth management services targeting younger investors.

- Insurtech solutions improving accessibility and efficiency.

- Drivers:

- Real Estate Technology (PropTech)

- Drivers:

- Technology-driven optimization in real estate transactions and property management.

- Demand for data centers and logistics hubs due to e-commerce growth.

- Focus on sustainable real estate developments.

- Growth Areas:

- Smart homes and IoT-enabled buildings.

- Real estate platforms using AI for analytics and decision-making.

- Growth in urban warehousing and industrial real estate.

- Drivers:

Conclusion

The U.S. economy in 2025 is expected to thrive on the back of technology innovation, healthcare advancements, and sustainable energy transformation. Policymaking and consumer trends will further enhance opportunities in consumer discretionary, industrials, and financial services, ensuring a robust foundation for economic expansion. Investors should prioritize these sectors for growth and resilience.

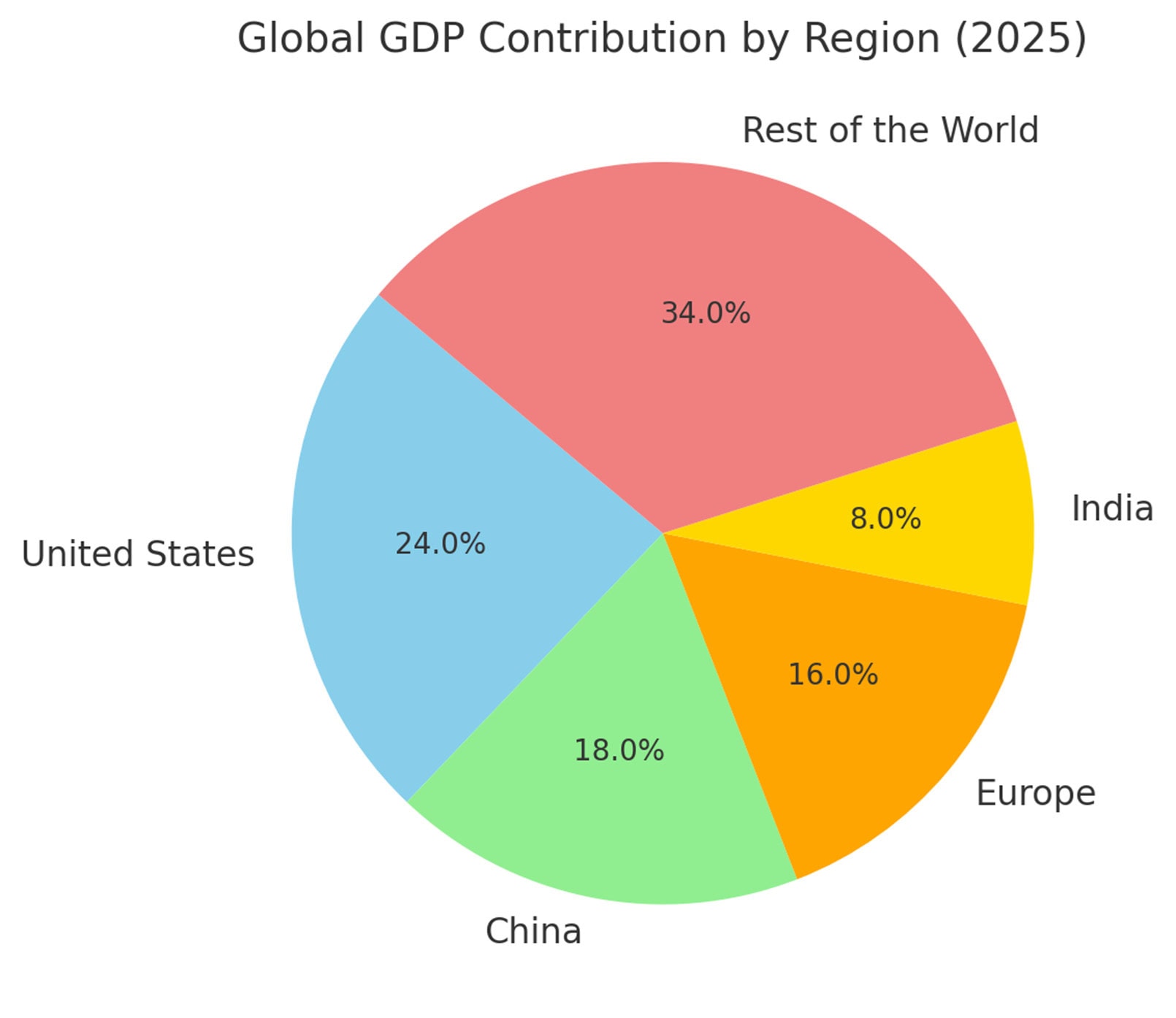

Global GDP Contribution by Region (2025)

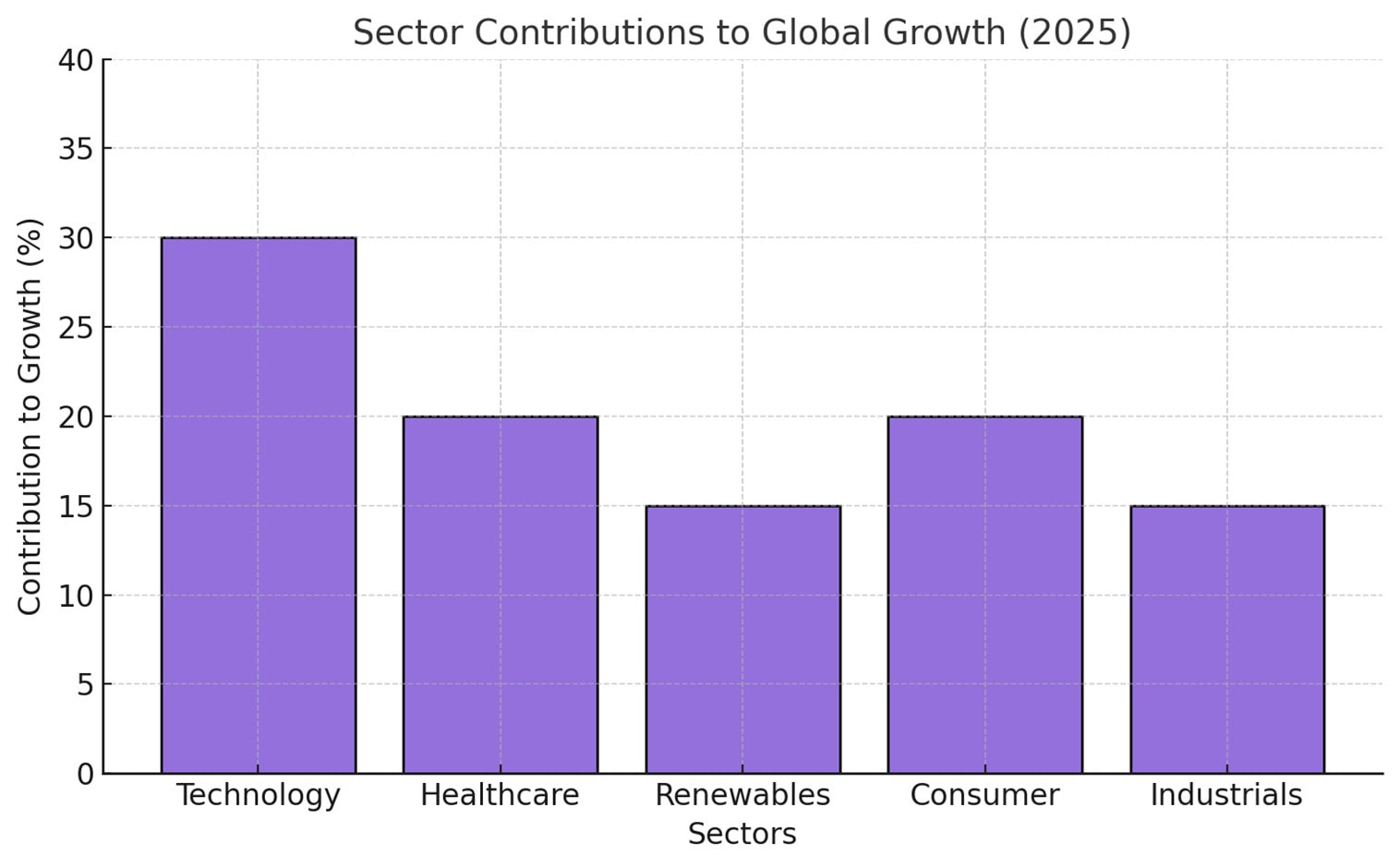

Sector Contributions to Global Growth (2025)

The graphs above provide additional insights into the Global Economic Environment for 2025:

- Global GDP Contribution by Region: Highlights the major contributors to global GDP, with the United States (24%) and China (18%) leading, followed by Europe (16%), India (8%), and the Rest of the World (34%). This showcases the dominant role of developed and emerging economies in shaping global growth.

- Sector Contributions to Global Growth: Displays the percentage contribution of key sectors to global economic growth. Technology (30%) leads as a driver, followed by Healthcare (20%), Consumer (20%), Renewables (15%), and Industrials (15%), reflecting the sectors propelling economic expansion.

These graphs underscore the importance of regional and sectoral dynamics in investment strategies for 2025.

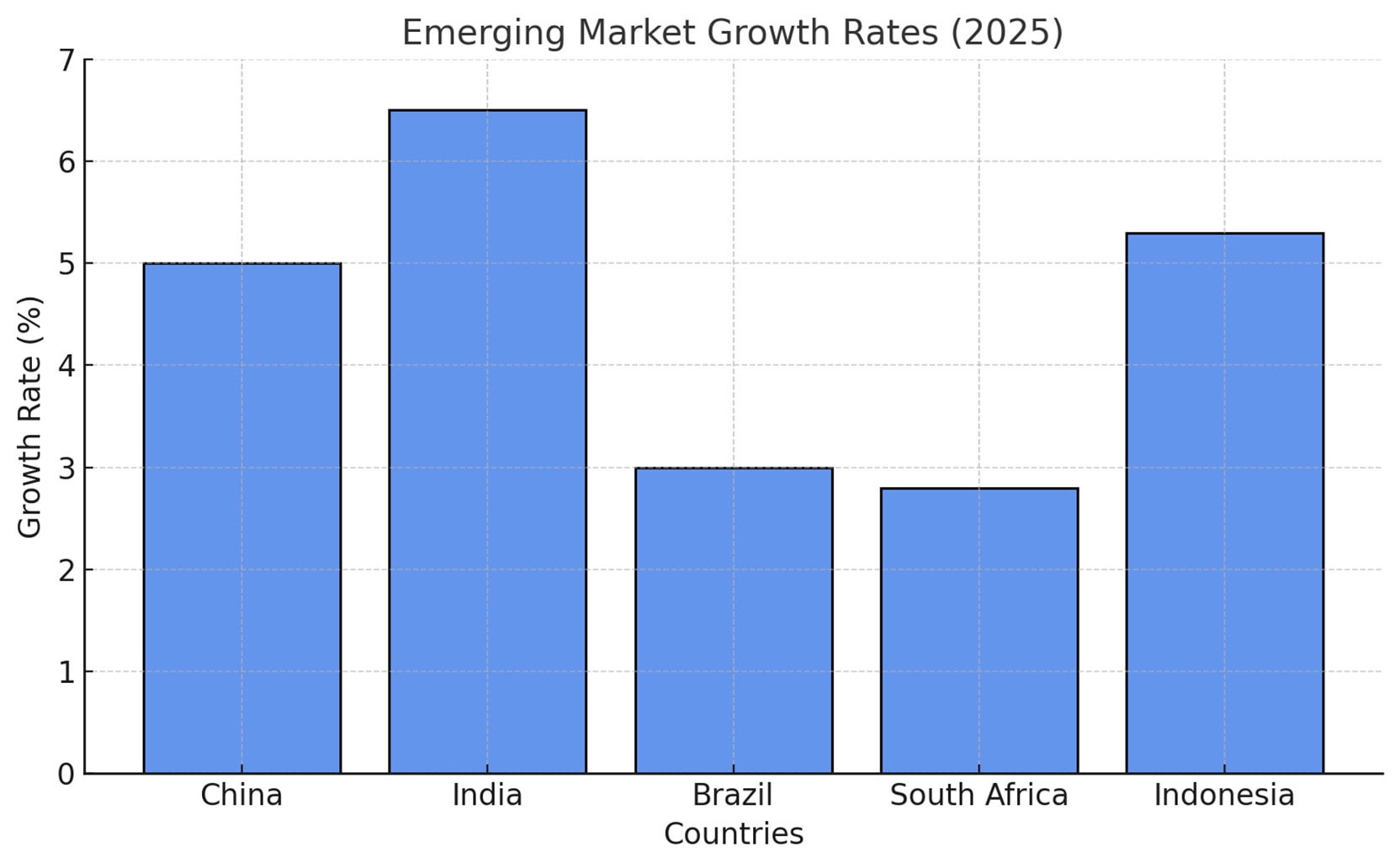

Emerging Market Growth Rates (2025)

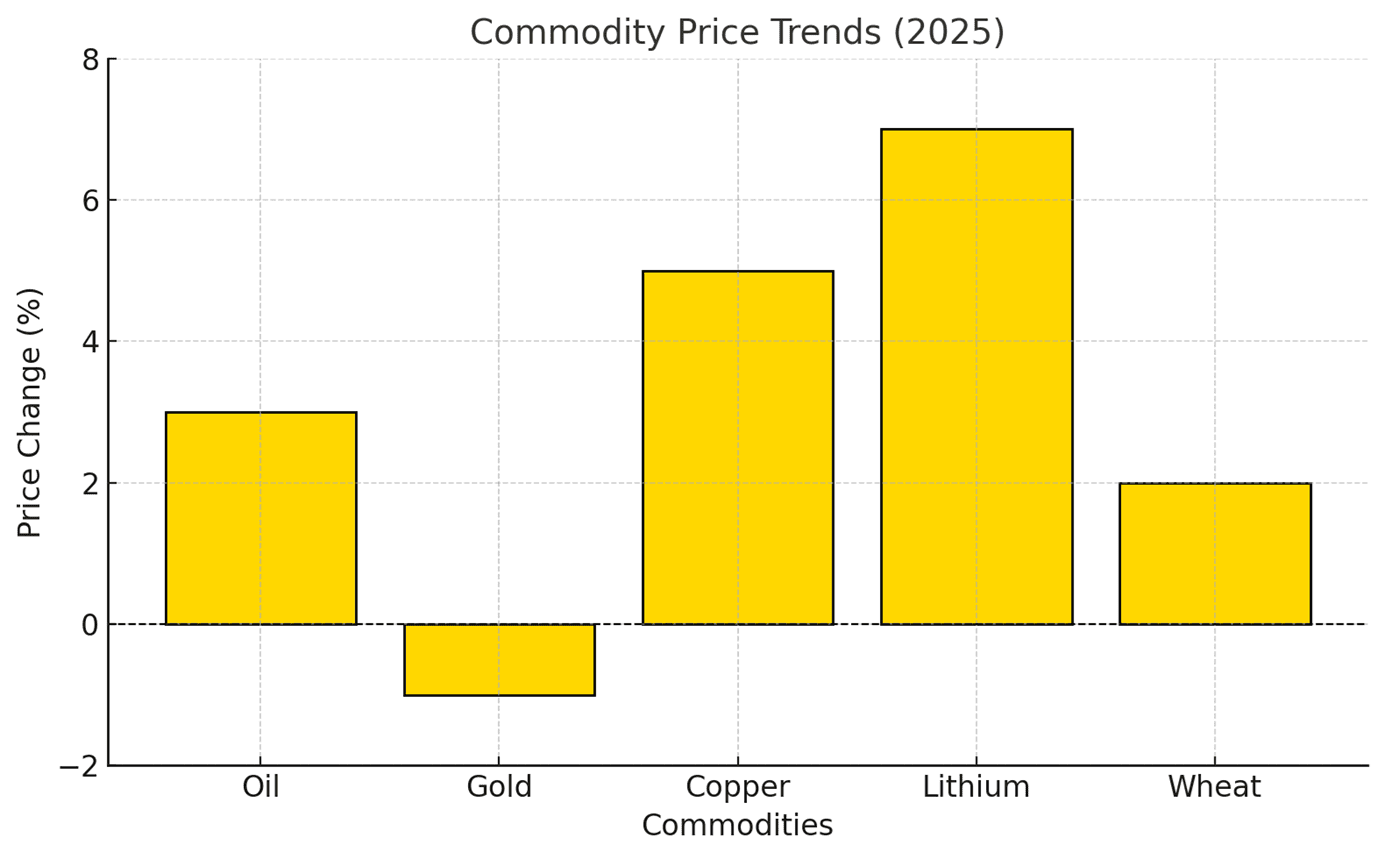

Commodity Price Trends (2025)

The additional graphs further illustrate key aspects of the Global Economic Environment for 2025:

- Emerging Market Growth Rates: Highlights the growth dynamics of key emerging markets, with India (6.5%) and Indonesia (5.3%) leading, followed by China (5.0%), Brazil (3.0%), and South Africa (2.8%). This emphasizes the robust economic expansion in Asia while other regions show more moderate growth.

- Commodity Price Trends: Shows the projected price changes for major commodities in 2025. Notable increases are expected in Lithium (7%) and Copper (5%) due to demand from green technologies, while Oil prices rise modestly (3%). Gold sees a slight decline (-1%), reflecting reduced safe-haven demand, and Wheat prices show a minor increase (2%).

These trends are crucial for understanding investment opportunities and risks tied to emerging markets and commodity sectors.

Long-Term Inflation Trends (2023-2030)

The graph illustrates the long-term inflation trends projected from 2023 to 2030:

- Developed Markets: Inflation is expected to steadily decline, stabilizing around 2.1%-2.2% by 2030. This reflects the impact of effective monetary policy and structural stability in these economies.

Emerging Markets: Inflation trends show a sharper decline, moving from 7.5% in 2023 to approximately 3.0% by 2030. This indicates improvements in fiscal management, monetary policy, and economic modernization in many emerging economies.

Conclusion of the U.S. Overweight-Focused Investment Strategy for 2025

- U.S.-Centric Allocation: Why 75%?

The 70% allocation to U.S. equities reflects the following factors:

-

- Economic Resilience: The U.S. economy, with stable GDP growth (~2%) and moderating inflation (~2%-2.5%), offers a conducive environment for corporate earnings growth.

- Sectoral Leadership: U.S. markets are home to leading companies in technology, healthcare, and renewable energy—the primary growth drivers for 2025. These sectors benefit from structural advantages, including innovation, global market leadership, and policy support.

- Liquidity and Depth: The U.S. market’s depth, liquidity, and transparency reduce risks associated with investing in less mature or volatile markets.

- Sector Analysis

Technology (50%)

-

- Dominance in AI and Cloud Computing: Companies like NVIDIA, Microsoft, and Alphabet are at the forefront of the global AI revolution, projected to add significant value across industries.

- Semiconductors and Hardware: The U.S. maintains a strategic lead in semiconductors, crucial for AI, IoT, and 5G rollouts.

- Cybersecurity: Increasing digital threats and regulatory mandates boost demand for cybersecurity solutions, where U.S. firms are key players.

Healthcare (10%)

-

- Aging Population: The U.S. demographic profile supports long-term demand for pharmaceuticals and healthcare services.

- Biotech and Genomics: Innovations in gene therapies, personalized medicine, and biologics create high-growth opportunities for investors.

- Health Tech: Digital health solutions and telemedicine platforms will continue to transform care delivery, with U.S. firms leading adoption.

Renewable Energy (5%)

-

- Policy Tailwinds: The Inflation Reduction Act (IRA) and other incentives prioritize clean energy, making this sector a cornerstone of U.S. growth.

- Electric Vehicles and Infrastructure: Expansion in EV adoption, charging networks, and grid modernization underpins robust growth.

- Export Opportunities: U.S. leadership in renewables positions it to benefit from global decarbonization efforts.

Consumer Staples and Discretionary (10%)

-

- Resilient Spending: Strong labor markets and wage growth support consumer purchasing power, particularly in discretionary sectors like travel, leisure, and e-commerce.

- Premiumization: Affluent consumers continue to drive demand for high-end goods, benefiting brands with strong pricing power.

- International Diversification: Why 20%?

Developed Markets (10%)

-

- Europe (10%):

- Opportunities in green energy align with global sustainability trends.

- Luxury goods makers (e.g., LVMH, Hermès) benefit from resilient demand, particularly in Asia and the U.S.

- Japan (2%):

- Corporate reforms and leadership in robotics and automation create value for investors.

- A stronger yen could enhance returns for dollar-based investors.

- Europe (10%):

Emerging Markets (10%)

-

- Asia (8%):

- China: Post-pandemic recovery driven by domestic consumption and tech leadership.

- India: Manufacturing expansion and digitalization contribute to outsized growth (~6.5% GDP growth in 2025).

- Latin America (2%):

- Commodities such as copper and lithium gain from global demand for EVs and renewable energy technologies.

- Asia (8%):

- Thematic Opportunities

AI and Automation

-

- The exponential growth of AI and robotics is reshaping industries, creating opportunities across sectors like healthcare, manufacturing, and consumer services.

Energy Transition

-

- Renewable energy and decarbonization efforts are structural drivers that will dominate global and U.S. policy for years, ensuring sustained growth.

Healthcare Innovation

-

- Advances in biotechnology and medical technology not only address global health challenges but also offer high growth potential for investors.

- Risk Considerations

-

- Overexposure to Technology: While U.S. technology leads global innovation, the concentration risk requires diversification within the sector (e.g., between software, hardware, and services).

- Geopolitical Tensions: Escalating U.S.-China tensions could affect multinational tech and consumer companies reliant on Chinese markets.

- Emerging Market Volatility: Currency risks and political instability in emerging markets may pose short-term challenges despite their long-term potential.

- Why This Strategy Stands Out

-

- Growth and Stability: By anchoring the portfolio in U.S. equities, the strategy combines growth potential with the stability of the world’s largest economy.

- Thematic Alignment: The focus on AI, renewables, and healthcare aligns with long-term global trends, ensuring sustainable growth.

- Global Exposure: The inclusion of developed and emerging markets provides diversification and access to high-growth regions.

Conclusion

This U.S.-focused investment strategy balances the country’s economic strengths and sectoral leadership with the diversification necessary for long-term resilience. It capitalizes on structural trends like AI, healthcare innovation, and renewable energy while mitigating risks through global exposure. By maintaining a strong emphasis on U.S. equities and selectively integrating global opportunities, investors can achieve robust returns in 2025 and beyond.

Licensed by FINMA as a Swiss Asset Manager