Annual Review 2021 – Outlook for 2022

Global Wealth Asset Management – Annual Review and 2022 Outlook

2021 Market Review

2021 was a year of gradual economic reopening, but markets faced significant headwinds from persistent COVID-19 disruptions, inflationary pressures, and cautious central bank policies. Vaccine rollouts provided a foundation for recovery, though regional differences in COVID-19 responses, economic resilience, and government policies shaped varied growth trajectories.

Market and Economic Overview

United States

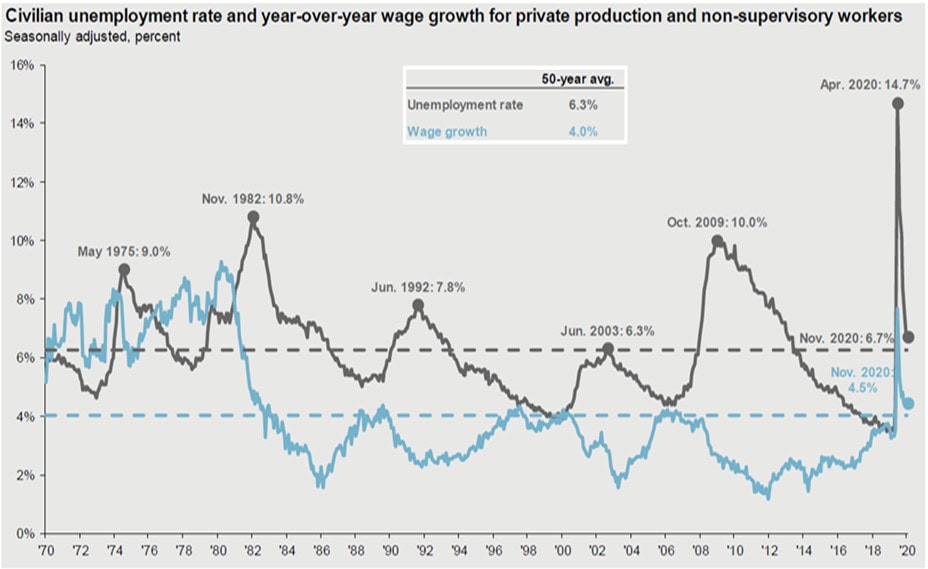

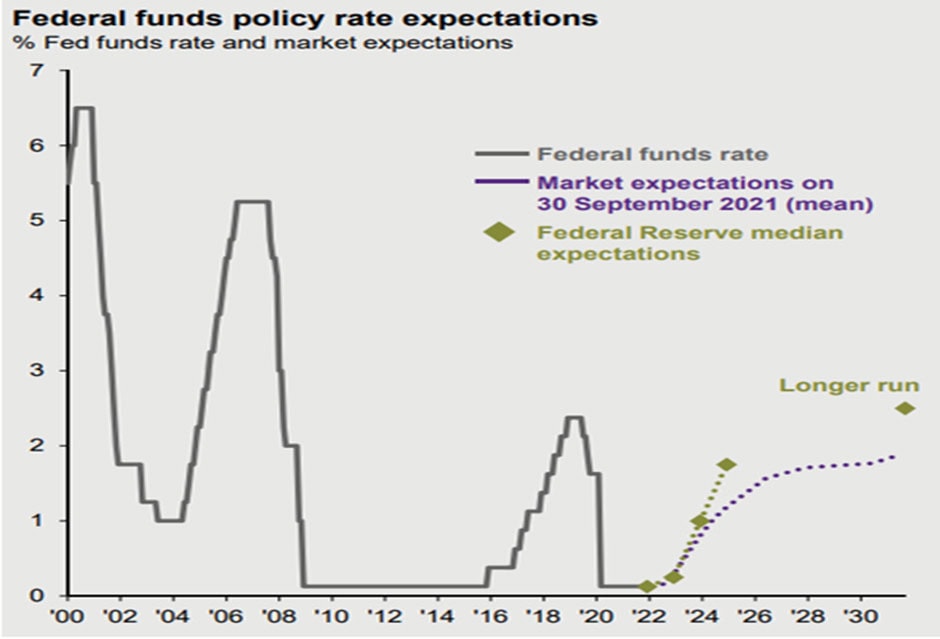

The U.S. economy benefited from low interest rates and liquidity support, though inflation became a pressing concern by year-end. Market performance was strong, with major indices like the S&P 500, Dow Jones, and Nasdaq closing the year with solid gains. Technology led the rally as digital transformation continued, while retail and energy sectors rebounded with increasing consumer activity. Despite the Federal Reserve’s commitment to supporting recovery, inflation pressures suggest an eventual shift in monetary policy to higher rates.

Europe

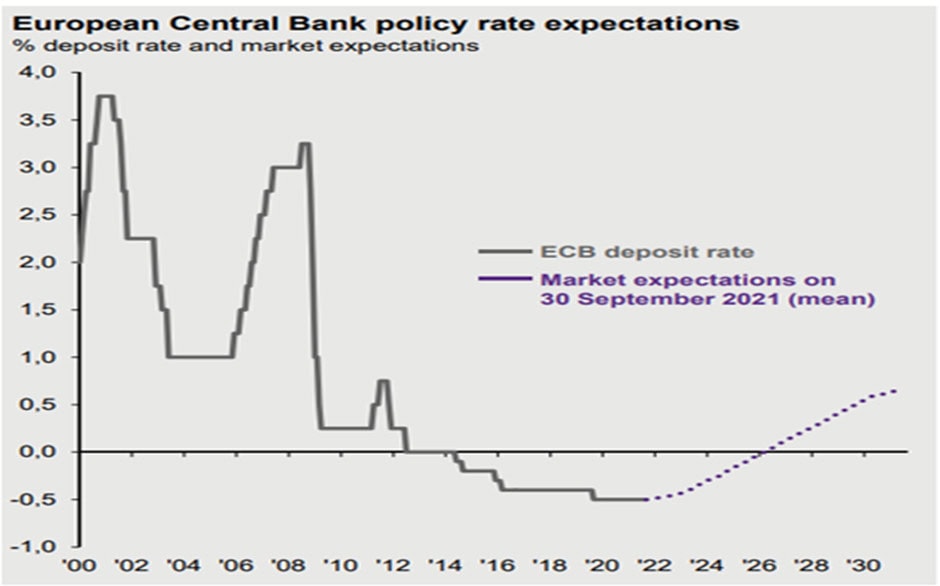

Europe faced uneven recovery patterns across member states, with divergent economic outcomes. Germany, especially following Merkel’s exit, is navigating a transitional period with potential economic modernization on the horizon. Meanwhile, the ECB maintained accommodative policies to manage inflation and support growth. Still, structural challenges persist, and Europe is expected to see slower, steadier growth compared to the U.S.

Asia and Emerging Markets

China emerged as a standout, showing significant resilience as its economy rebounded from the pandemic sooner than most. Manufacturing and export growth reinforced its economic dominance, although ongoing U.S.-China tensions may periodically affect market stability. Japan, although impacted by the postponed Olympics, showed a moderate recovery in GDP and stable performance in sectors supported by government infrastructure investments.

Sector Analysis and Highlights

Technology

2021 was another year of robust performance for technology, driven by increased investment in cloud computing, cybersecurity, and AI. Major players continued capitalizing on strong cash flows, positioning themselves for future growth. As digital transformation shows no signs of slowing, this sector remains a high-priority area.

Energy and Commodities

Energy markets witnessed sharp price increases, particularly in oil and natural gas, raising inflation concerns worldwide. Although these levels may moderate, energy’s impact on inflation and market volatility has been notable. With renewed interest in green energy, investments in renewable infrastructure continue to hold long-term promise.

Healthcare and Biotech

Healthcare, particularly biotech, presented growth opportunities as the world continued addressing COVID-19 and new health challenges. Vaccine technology, along with health system upgrades, remains a crucial area for innovation and investment.

Investment Strategy and Asset Allocation Outlook for 2022

In 2022, we expect sustained growth, especially in the U.S. and emerging markets, but with heightened caution around inflation and interest rate risks. Here’s how we’re positioning our portfolio for the year:

-

Strategic Asset Allocation

-

-

Equities: Our strategy remains heavily U.S.-focused, with an 80% allocation to equities. Technology, as our top sector, will occupy around 60% of our equity exposure. The U.S. continues to show strong growth fundamentals, particularly in sectors like technology and consumer goods, backed by corporate liquidity and resilience.

-

International Equities: While the U.S. remains our primary allocation, selective opportunities in emerging markets—especially in Asia—are on our radar. With strong economic recovery and favorable investment climates, these regions present growth opportunities that complement our U.S. positions.

-

-

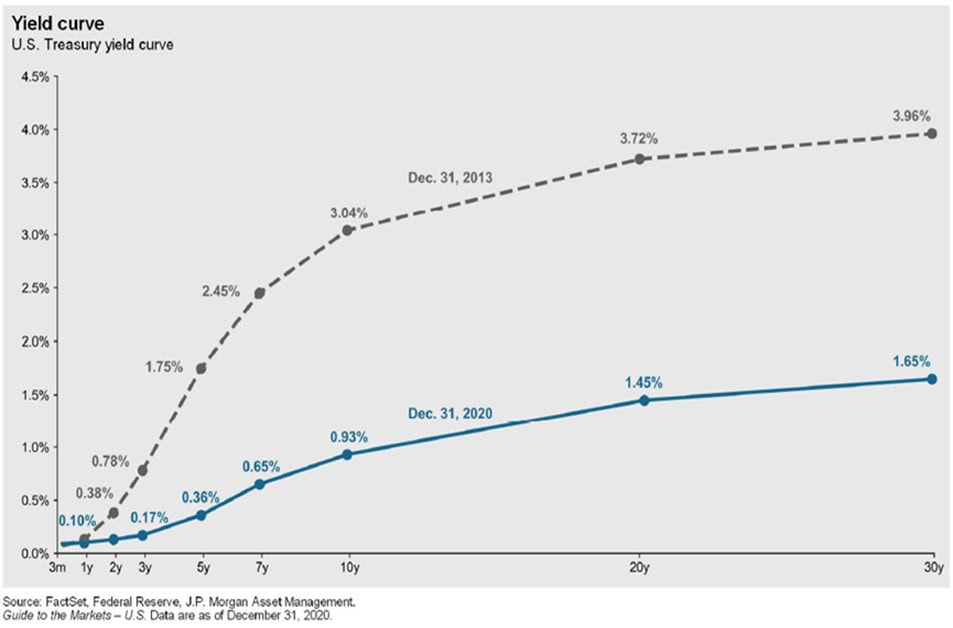

Bonds and Interest Rate Sensitivity

-

-

Developed Market Bonds: Given expected rate hikes, our bond strategy will be cautious, with limited exposure to U.S. Treasuries. We will prioritize bonds with moderate sensitivity to rising rates, looking for select opportunities with reasonable yields and risk balance.

-

Emerging Market Bonds: Higher yields in emerging markets make them attractive within our bond allocation. These bonds offer potential growth but come with currency risk and volatility considerations, which we will manage with a selective approach.

-

-

Sector-Specific Focus

-

-

Technology and Innovation: We continue to prioritize technology, especially companies leading in AI, cloud computing, and cybersecurity. These subsectors offer strong growth prospects as companies double down on digital investments.

-

Healthcare and Biotech: Biotech and healthcare innovations, particularly those supporting vaccine and health infrastructure advancements, present high-growth potential, making them an attractive secondary focus.

-

Energy and Green Initiatives: With inflationary pressures tied to energy prices, we are closely monitoring this sector. In addition to traditional energy, renewable energy remains a compelling theme as countries shift toward sustainable infrastructure investments.

-

-

Liquidity and Flexibility

-

-

We will maintain a portion of our portfolio in short-term deposits and cash equivalents, providing liquidity to respond dynamically to market changes. This flexibility allows us to seize new investment opportunities while maintaining a defensive buffer against volatility.

-

Conclusion

Our 2022 outlook balances optimism with vigilance. The U.S. and key emerging markets appear well-positioned for growth, but inflation and interest rate shifts could introduce volatility. By focusing on resilient, high-growth sectors, particularly in U.S. equities and technology, we are prepared to capitalize on economic recovery while managing potential risks. Our approach emphasizes adaptability, positioning us to navigate an evolving global landscape with both agility and foresight.

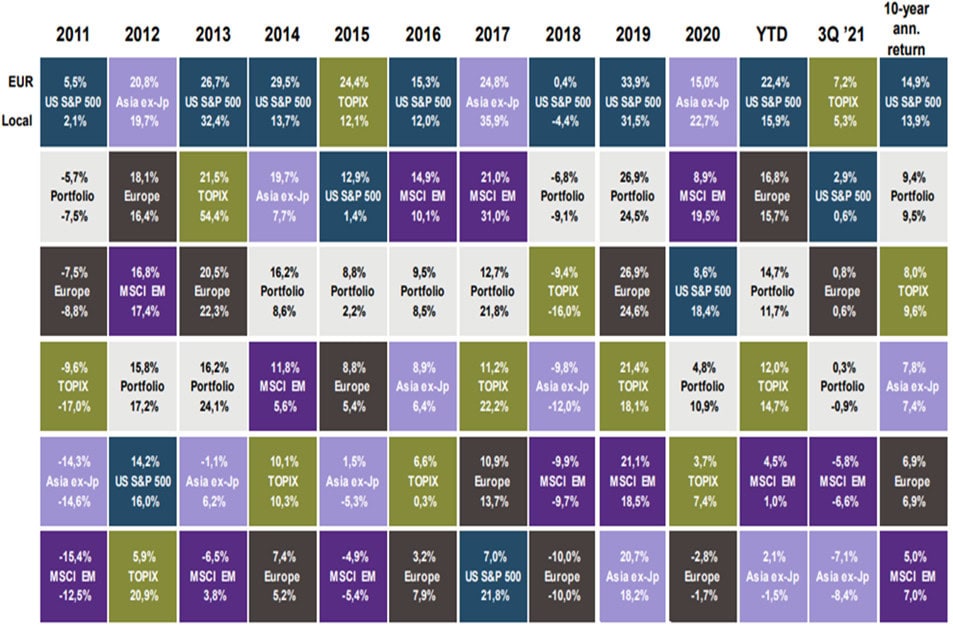

Relevant Graphs to the Economic Outlook

Πηγή: BLS, FactSet, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of December 31, 2020

Source: MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. Annualised return covers the period 2011 to 2020. Hypothetical portfolio (for illustrative purposes only and should not be taken as a recommendation): 35% Europe; 30% S&P 500; 15% EM; 10% Asia ex-Japan; 10% TOPIX. All indices are total return. YTD is year to date. Past performance is not a reliable indicator of current and future results. Guide to the Markets – Europe. Data as of 30 September 2021.